The Wine Industry Boosts the Texas Economy by

$13.1 billion

in 2017

The production, distribution, sales, and consumption of wine in Texas benefits many sectors of the state’s economy and generates close to $13.1 billion in total economic activity. This ultimate value-added product preserves agricultural land, provides American jobs, attracts tourists, generates taxes, and enhances the quality of life.

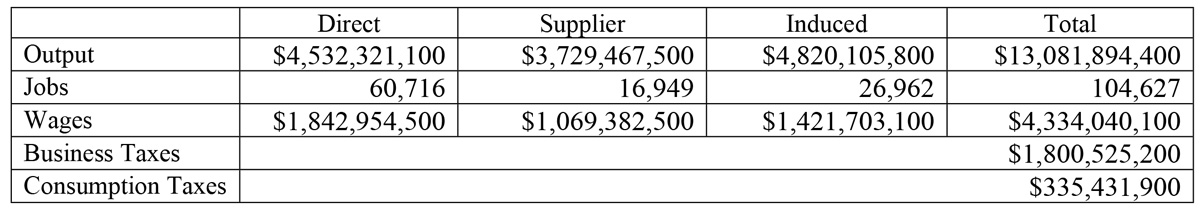

Economic Impact of the Wine Industry in Texas

Total Output: The wine industry generates close to $13.1 billion in total economic activity in the State of Texas, dramatically illustrating that wine is the ultimate value-added beverage. The broader economic impact flows throughout the state, generating business for firms seemingly unrelated to the wine industry. Real people, with real jobs, working in industries as varied as farming, banking, accounting, manufacturing, packaging, transportation, printing, and advertising depend on the wine industry for their livelihoods.

State Reach: The Texas wine industry includes a total of 394 wine producers as well as 4,368 acres of vineyards.

Job Creation: The Texas wine industry directly employs as many as 60,716 people, and generates an additional 16,949 jobs in supplier and ancillary industries which supply goods and services to the industry, and whose sales depend on the wine industry’s economic activity. Ultimately, 104,627 jobs are created and supported by the wine industry.

Wage Generation: The Texas wine industry provides good jobs, paying an average of $41,400 in annual wages and benefits. The total wages generated by direct, indirect, and induced economic activity driven by the wine industry are $4.3 billion.

Tourist Activity: The Texas wine industry is a major magnet for tourists and tourism-driven expenses. Texas’ “wine country” regions generates 1.7 million tourist visits and $716.6 million in annual tourism expenditures, benefiting local economies and tax bases.

Tax Revenues: The Texas wine industry generates sizeable tax revenues on the local, state, and national levels.In 2017, the industry will pay nearly $802.2 million in state and local taxes, and $998.4 million in federal taxes for a total of $1.8 billion. In addition, the industry generates approximately $66.2 million federal consumption taxes and $269.2 million in state consumption taxes which include excise and sales taxes.